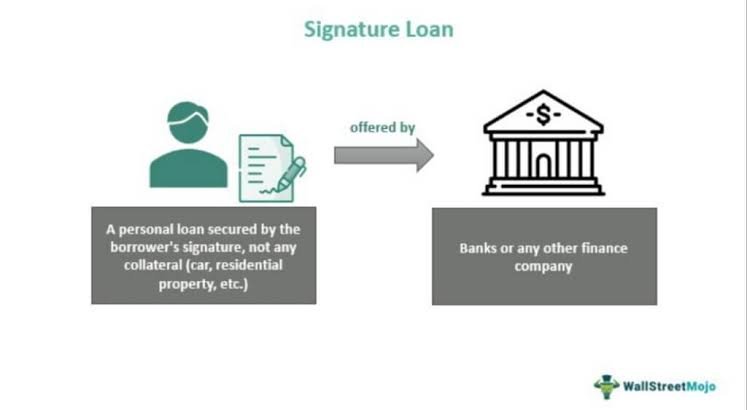

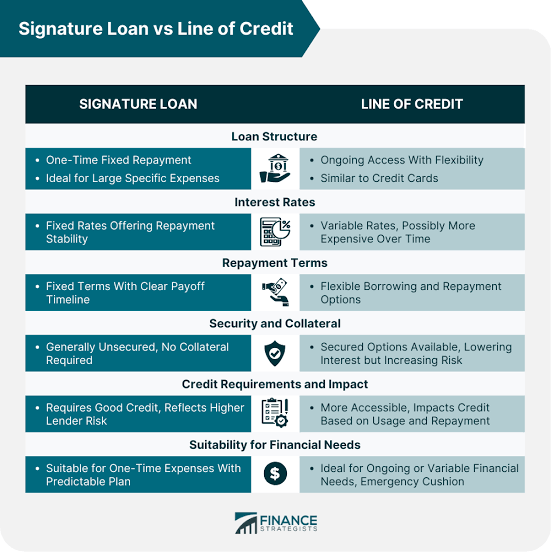

A signature loan, also known as a good faith loan or character loan, is a type of unsecured personal loan that requires only the borrower’s signature and promise to repay—no collateral is needed. These loans are typically offered by banks, credit unions, and online lenders.

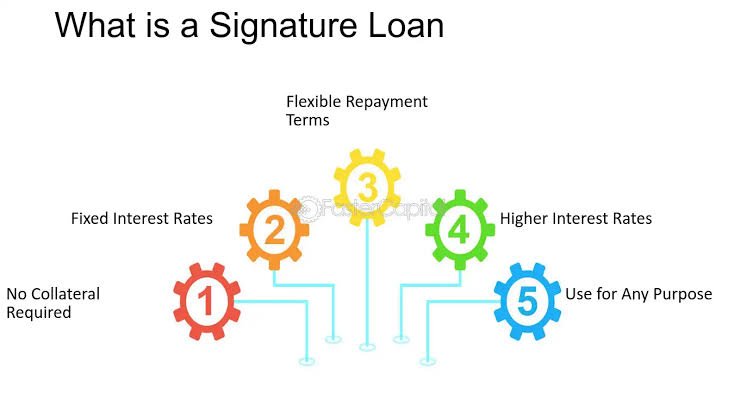

Key Features of a Signature Loan

- No Collateral Required – Unlike secured loans, such as mortgages or auto loans, signature loans do not require assets as security.

- Fixed Interest Rates – Most signature loans come with fixed interest rates, meaning the monthly payments remain consistent throughout the loan term.

- Quick Approval Process – Since no collateral is involved, approval is based on the borrower’s creditworthiness, income, and financial history.

- Flexible Usage – Borrowers can use signature loans for various purposes, including debt consolidation, medical expenses, home improvements, or emergency costs.

- Higher Interest Rates – Due to the lack of collateral, lenders charge higher interest rates compared to secured loans.

Eligibility Criteria

To qualify for a signature loan, lenders typically assess:

- Credit Score – A high credit score increases the chances of approval and lowers interest rates.

- Income Stability – Lenders require proof of steady income to ensure the borrower can repay the loan.

- Debt-to-Income Ratio – A lower debt-to-income ratio indicates financial stability and improves approval chances.

- Co-Signer Option – Some lenders may require a co-signer if the borrower has a lower credit score.

Advantages of Signature Loans

- Fast Processing – Funds are often disbursed quickly, making them ideal for urgent financial needs.

- No Asset Risk – Since no collateral is required, borrowers do not risk losing property in case of default.

- Fixed Repayment Terms – Predictable monthly payments help borrowers manage finances effectively.

Disadvantages of Signature Loans

- Higher Interest Rates – Compared to secured loans, signature loans tend to have higher interest rates.

- Strict Credit Requirements – Borrowers with poor credit may struggle to qualify or face higher rates.

- Potential Debt Trap – Misuse of funds or failure to repay can lead to financial difficulties.

How to Apply for a Signature Loan

- Check Credit Score – Ensure your credit score meets the lender’s requirements.

- Compare Lenders – Research different lenders to find the best interest rates and terms.

- Gather Documents – Prepare necessary documents, including proof of income, identification, and credit history.

- Submit Application – Apply online or in person with the chosen lender.

- Review Loan Terms – Carefully read the loan agreement before signing.

Conclusion

Signature loans provide a convenient financing option for individuals who need quick access to funds without pledging collateral. However, borrowers should carefully assess their financial situation and repayment ability before applying. Comparing lenders and understanding loan terms can help secure the best deal.