USDA loans, also known as Rural Development loans, are a unique type of mortgage offered through the U.S. Department of Agriculture’s Rural Development program. Established in 1937, this program aims to promote homeownership among low- to moderate-income individuals in rural and suburban areas of the United States. By providing affordable financing options, USDA loans help make owning a home more accessible for those who might not qualify for conventional mortgages. This comprehensive overview explores what USDA loans are, their types, eligibility requirements, benefits, drawbacks, and the application process.

What Are USDA Loans?

USDA loans are government-backed mortgages designed to assist homebuyers in designated rural and suburban areas. Administered by the USDA’s Rural Development program, these loans target individuals and families with limited financial resources, offering terms that are often more favorable than those of traditional loans. The primary goal is to encourage development in less densely populated regions by making homeownership attainable for those with modest incomes .

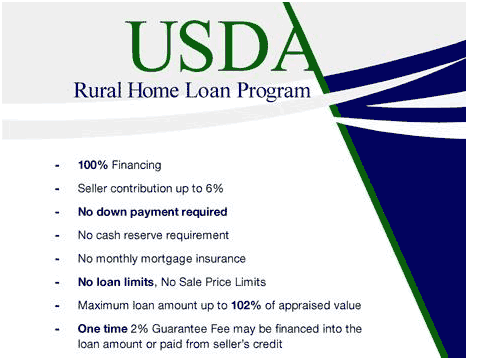

One of the standout features of USDA loans is the absence of a down payment requirement, a rarity among mortgage options. This, combined with competitive interest rates and lenient credit guidelines, positions USDA loans as an attractive choice for eligible buyers. However, these loans come with specific restrictions, such as income limits and property location requirements, which ensure the program serves its intended demographic .

Types of USDA Loans

The USDA offers several loan programs, each tailored to different needs and financial situations. The two primary types for home purchases are USDA Guaranteed Loans and USDA Direct Loans, with an additional program for home repairs.

- USDA Guaranteed Loans: Officially known as Section 502 Guaranteed Loans, these are issued by private lenders but backed by the USDA. The government guarantees up to 90% of the loan amount, reducing the risk for lenders and allowing them to offer favorable terms. These loans are available to households with incomes up to 115% of the area’s median income (AMI) and typically require a credit score of at least 620, though this can vary by lender. Borrowers must pay an upfront guarantee fee of 1% of the loan amount and an annual fee of 0.35%, which is added to monthly payments .

- USDA Direct Loans: Known as Section 502 Direct Loans, these are funded directly by the USDA and target very low- to low-income households (up to 80% of AMI). Unlike guaranteed loans, there is no minimum credit score requirement, though borrowers must demonstrate the ability to repay. Interest rates are fixed, often as low as 1% with payment assistance, and terms can extend up to 38 years for very low-income applicants. Funding for direct loans is limited and based on need, making them less common than guaranteed loans .

- USDA Repair Loans and Grants: Under the Section 504 Home Repair program, the USDA provides loans up to $40,000 for home improvements and grants up to $10,000 for very low-income homeowners aged 62 or older to address safety hazards. These are designed for existing homeowners rather than new purchases .

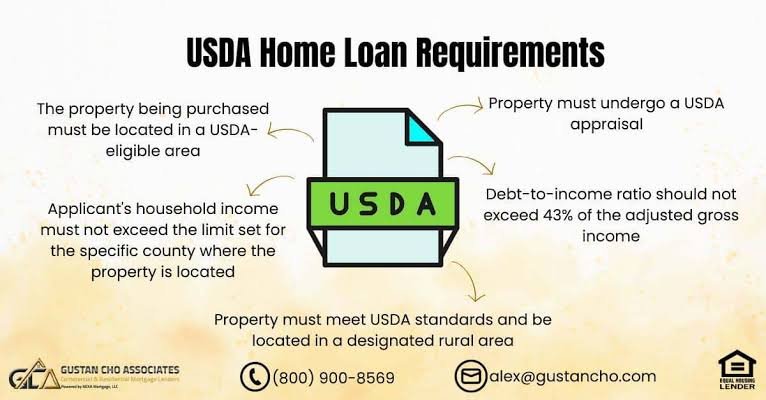

Eligibility Requirements

Eligibility for USDA loans hinges on several factors, including borrower qualifications, income limits, and property location.

- Borrower Qualifications: Applicants must be U.S. citizens or permanent residents and intend to occupy the home as their primary residence. They cannot be suspended or debarred from federal programs .

- Income Limits: Income eligibility varies by loan type and location. For guaranteed loans, household income must not exceed 115% of the area’s median income, while direct loans are restricted to those earning 50-80% of AMI. These limits adjust based on family size and county, with higher thresholds in more expensive areas. The USDA website provides tools to check specific income limits .

- Credit Requirements: While the USDA does not set a universal credit score minimum, most lenders require at least 620-640 for guaranteed loans. Direct loans focus more on repayment ability than a specific score .

- Property Location: Properties must be located in USDA-designated rural areas, which are determined by population size and proximity to urban centers. Contrary to common misconceptions, “rural” includes many suburban areas, with nearly 97% of U.S. land qualifying. The USDA’s online eligibility map helps confirm if a property meets this criterion 24.

- Property Type: Only single-family homes that meet USDA minimum property standards are eligible. Multi-unit properties, investment properties, and vacation homes do not qualify .

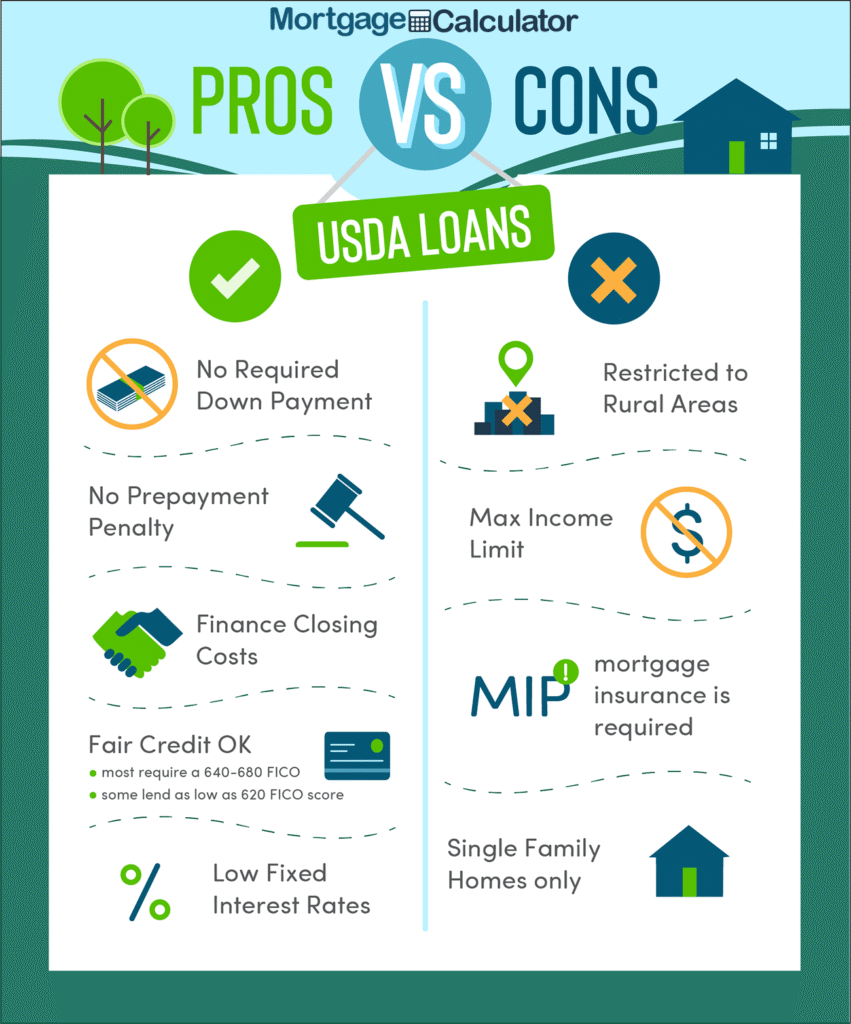

Benefits of USDA Loans

USDA loans offer several advantages that make them appealing to eligible borrowers:

- No Down Payment: Unlike conventional loans, which often require 3-20% down, USDA loans allow 100% financing, removing a significant barrier to homeownership .

- Competitive Interest Rates: Rates for USDA loans are often lower than those for conventional mortgages, especially for direct loans, which can be as low as 1% with assistance .

- No Private Mortgage Insurance (PMI): While guaranteed loans have guarantee fees, they do not require PMI, which is mandatory for conventional loans with less than 20% down .

- Flexible Credit Guidelines: Particularly with direct loans, credit requirements are more lenient, focusing on repayment ability over strict score thresholds .

Drawbacks of USDA Loans

Despite their benefits, USDA loans have limitations that may not suit all buyers:

- Location Restrictions: Properties must be in designated rural areas, excluding urban homebuyers .

- Income Caps: Strict income limits can disqualify higher earners, even in rural areas .

- Guarantee Fees: For guaranteed loans, the upfront 1% and annual 0.35% fees add to the cost over the loan’s life, unlike PMI, which can sometimes be canceled .

- Limited Funding for Direct Loans: Direct loan availability depends on federal funding, which can lead to delays or unavailability in some areas .

Comparison to Other Mortgage Options

| Loan Type | Down Payment | Credit Score | Mortgage Insurance/Fees | Income Limits | Property Restrictions |

|---|---|---|---|---|---|

| USDA Loans | None | Typically 620+ | Upfront & annual guarantee fees | 115% of AMI (Guaranteed) | Rural areas only |

| Conventional Loans | 3-20% | Typically 620+ | PMI if <20% down | None | None |

| VA Loans | None | 620+ | Upfront fee | None | None |

| FHA Loans | 3.5% (10% if <580 score) | 500-580+ | Upfront & annual MIP | None | None |

This table highlights how USDA loans stand out with zero down payment and rural focus, but their income and location limits are more restrictive than other options .

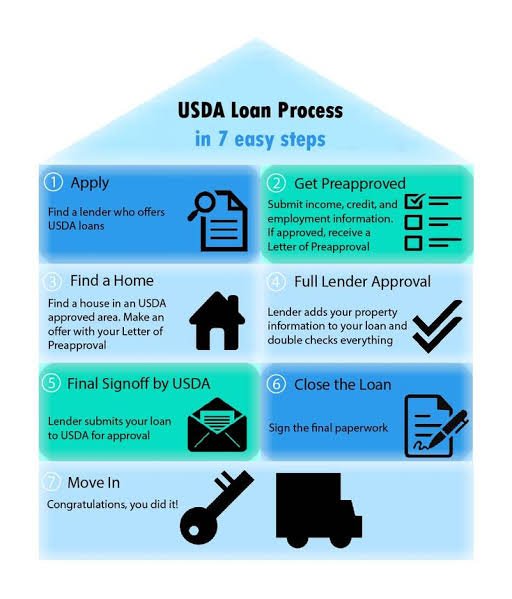

How to Apply for a USDA Loan

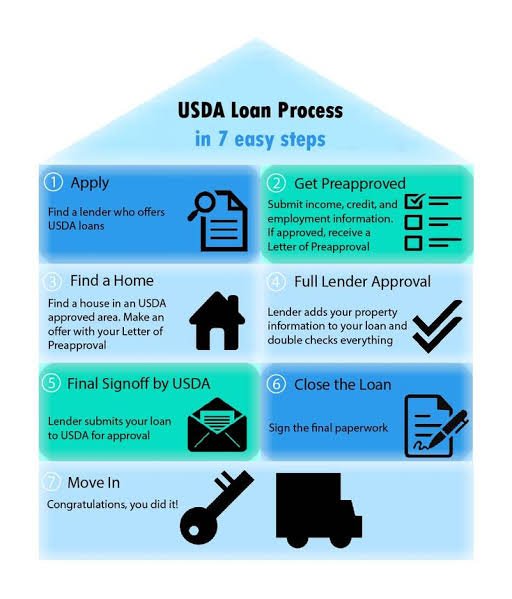

Applying for a USDA loan involves several steps, typically taking 30-45 days from pre-qualification to closing:

- Check Eligibility: Verify income limits and property location using USDA online tools .

- Find a Lender: For guaranteed loans, select a USDA-approved lender. For direct loans, contact a local USDA Rural Development office .

- Get Pre-Qualified: Provide financial and credit information for an initial assessment .

- Gather Documentation: Submit proof of income (pay stubs, tax returns), employment history, and assets .

- Apply for Pre-Approval: Strengthen your offer with formal pre-approval from the lender .

- Find a Property: Search for a USDA-eligible home and make an offer .

- Complete Appraisal and Underwriting: The lender orders a USDA appraisal and reviews all details .

- Close the Loan: Finalize the purchase by signing closing documents. Note that some borrowers may need to make a $1,000 investment at closing for transaction costs .

Conclusion

USDA loans provide a valuable pathway to homeownership for low- to moderate-income individuals in rural and suburban areas. With benefits like no down payment, low interest rates, and flexible credit requirements, they address financial barriers that often hinder conventional loan approval. However, restrictions on income, property location, and loan type suitability mean they are not a universal solution. By understanding the eligibility criteria and application process, potential borrowers can determine if a USDA loan aligns with their homebuying goals, contributing to the broader mission of rural development and community growth.