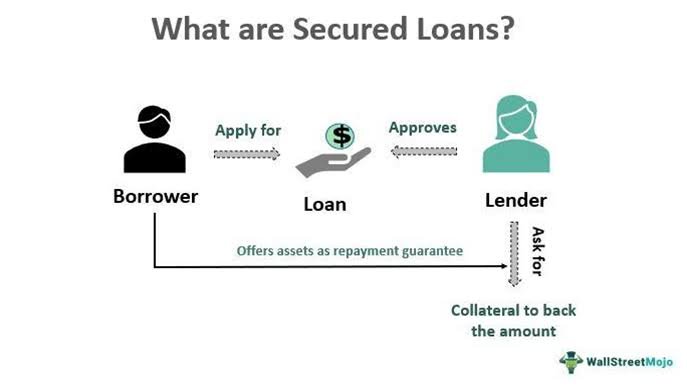

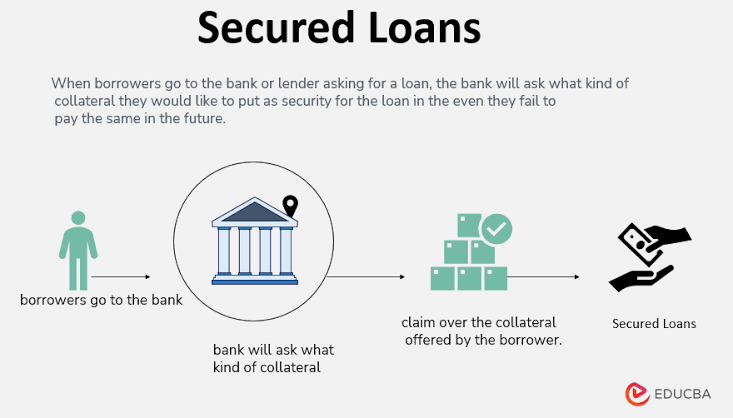

Secured loans, an essential pillar of the financial ecosystem, are loans in which the borrower pledges an asset as collateral for the loan. This mechanism reduces the risk for lenders and enables them to offer lower interest rates and more substantial loan amounts. The asset acts as a security, ensuring that lenders can recoup their losses if the borrower defaults. This relationship between borrower, lender, and asset forms the bedrock of secured loans.

Key Characteristics of Secured Loans

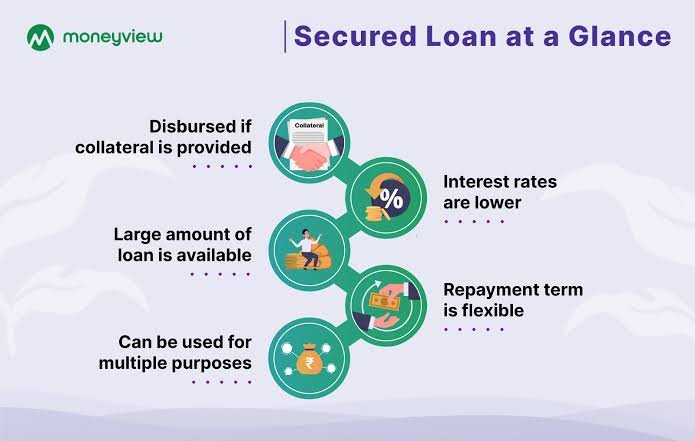

1. Collateral: The most defining feature of a secured loan is the collateral. Common types of collateral include real estate, vehicles, stocks, bonds, and savings accounts. The choice of collateral often depends on the type of secured loan being sought.

2. Lower Interest Rates: Because the risk to the lender is mitigated by the collateral, secured loans typically have lower interest rates compared to unsecured loans. This makes them an attractive option for borrowers looking for affordable financing options.

3. Higher Borrowing Limits: Lenders are more willing to extend larger sums of money to borrowers who offer collateral. This is particularly useful for significant purchases or investments, such as buying a home or starting a business.

4. Repayment Terms: Secured loans often come with longer repayment terms, allowing borrowers to repay the loan over an extended period. This can make monthly payments more manageable, though it may also mean paying more interest over the life of the loan.

Types of Secured Loans

1. Home Loans (Mortgages): One of the most common types of secured loans, home loans, or mortgages, are used to purchase real estate. The property itself serves as collateral. Mortgages come in various forms, including fixed-rate and adjustable-rate mortgages, each with its own set of terms and conditions.

2. Auto Loans: These loans are used to finance the purchase of a vehicle, with the vehicle acting as collateral. Auto loans typically have shorter repayment terms compared to home loans, usually ranging from three to seven years.

3. Secured Personal Loans: Borrowers can use these loans for various purposes, such as home improvement, medical expenses, or debt consolidation. The collateral for secured personal loans can vary widely, including savings accounts, certificates of deposit (CDs), or other personal assets.

4. Business Loans: Secured business loans provide funding for business operations, expansion, or equipment purchase. Collateral for these loans can include business assets like inventory, accounts receivable, or real estate. These loans can help businesses grow and manage their cash flow effectively.

Advantages of Secured Loans

1. Lower Interest Rates: The presence of collateral significantly reduces the risk for lenders, allowing them to offer lower interest rates. This can result in substantial savings for borrowers over the life of the loan.

2. Higher Loan Amounts: Secured loans often come with higher borrowing limits, making them suitable for significant financial needs, such as buying a home or funding a business.

3. Easier Approval: Because the risk to the lender is lower, secured loans are often easier to obtain, even for borrowers with less-than-perfect credit. This accessibility can be a lifeline for those who need financing but face challenges with creditworthiness.

4. Longer Repayment Terms: The extended repayment terms associated with secured loans can make monthly payments more affordable, reducing the financial strain on borrowers.

Disadvantages of Secured Loans

1. Risk of Asset Loss: The primary drawback of secured loans is the potential loss of the collateral. If the borrower defaults on the loan, the lender has the legal right to seize the asset to recover their losses. This can result in the loss of significant and valuable property, such as a home or vehicle.

2. Longer Approval Process: Secured loans often require a thorough evaluation of the collateral, which can lead to a longer approval process compared to unsecured loans. This can be a disadvantage for borrowers who need quick access to funds.

3. Complexity of Terms: Secured loans can come with complex terms and conditions, particularly for mortgages and business loans. Borrowers must carefully review and understand these terms to avoid potential pitfalls.

How to Apply for a Secured Loan

1. Assess Your Financial Needs: Determine the amount of money you need to borrow and the purpose of the loan. This will help you identify the appropriate type of secured loan for your situation.

2. Evaluate Your Collateral: Identify assets that can be used as collateral. Ensure that the value of the collateral meets the lender’s requirements and that you are comfortable with the risk of potentially losing the asset.

3. Research Lenders: Compare offers from multiple lenders, including banks, credit unions, and online lenders. Pay attention to interest rates, loan terms, fees, and the lender’s reputation.

4. Prepare Documentation: Gather necessary documentation, such as proof of income, identification, and details of the collateral. This will streamline the application process and improve your chances of approval.

5. Submit Your Application: Complete the loan application with your chosen lender. Be prepared to provide additional information or documentation if requested.

6. Review Loan Terms: Once approved, carefully review the loan agreement. Pay close attention to the interest rate, repayment terms, and any fees associated with the loan. Ensure that you fully understand the terms before signing the agreement.

7. Repay the Loan: Make timely payments according to the agreed-upon schedule. This will help you build a positive credit history and avoid the risk of losing your collateral.

Conclusion

Secured loans play a vital role in the financial landscape, offering borrowers the opportunity to access significant funding at affordable rates. While they come with the risk of asset loss, the benefits of lower interest rates, higher loan amounts, and easier approval make them a valuable option for many borrowers. Understanding the characteristics, advantages, and disadvantages of secured loans can help you make informed decisions and effectively manage your financial needs.

If you have any specific questions or need further details, feel free to ask! 📚💡