🌄 Introduction

In a world that craves flexibility, adventure, and freedom, Recreational Vehicles (RVs) represent more than just transportation—they embody a lifestyle. Whether it’s for weekend getaways, seasonal road trips, or full-time living on the move, RVs provide comfort, convenience, and mobility. However, with prices ranging from modest travel trailers to luxurious Class A motorhomes exceeding six figures, most buyers turn to RV loans to make this lifestyle dream affordable. This essay explores the dynamics of RV loans, their types, terms, eligibility, pros and cons, and tips for smart financing.

💸 What Is an RV Loan?

An RV loan is a type of financing used to purchase recreational vehicles like motorhomes, campers, trailers, and fifth wheels. These loans help borrowers pay for new or used RVs, allowing them to spread the cost over monthly installments instead of paying upfront.

Unlike conventional auto loans, RV loans may resemble mortgages due to their larger amounts and longer repayment periods—especially if the RV includes features like a bathroom, sleeping quarters, and kitchen space, qualifying it as a second home under certain regulations.

🛠️ Types of RV Loans

RV loans fall into two major categories:

| Loan Type | Description |

|---|---|

| Secured RV Loans | Backed by the RV itself as collateral; offers lower interest rates and longer terms |

| Unsecured RV Loans | Personal loans without collateral; higher rates but no risk of repossession |

Many lenders offer both types depending on creditworthiness and loan size. Dealership financing usually provides secured loans, while online lenders or banks might offer unsecured alternatives.

🏦 Sources of RV Loans

RV loans can be obtained through:

- RV Dealerships: Often partner with lenders to offer competitive rates

- Banks & Credit Unions: Provide secured loans with flexible terms

- Online Lenders: Offer convenience and quick approval processes

- Peer-to-Peer Platforms: Alternative financing with varied terms

📋 Eligibility Criteria

Qualifying for an RV loan depends on:

- Credit Score: Generally 660+ for favorable rates; 700+ unlocks premium options

- Debt-to-Income Ratio: Ideally below 40%

- Employment History: Stable income is essential

- Down Payment: Ranges from 10% to 20%, depending on the RV and lender

- Type of RV: Luxury models may require more stringent documentation and verification

Many lenders also require proof of insurance and registration, especially for high-end Class A motorhomes.

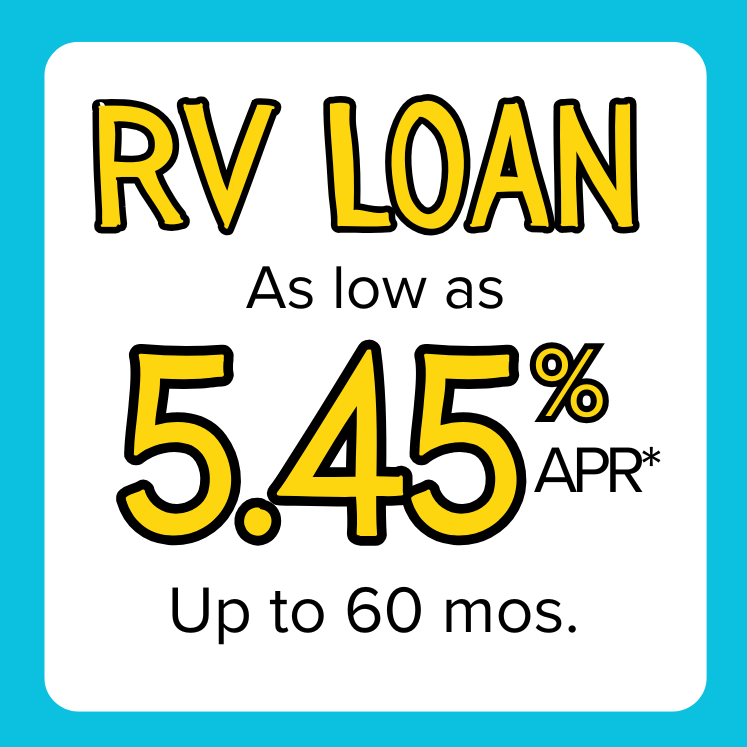

📊 Loan Terms and Interest Rates

RV loan terms vary significantly:

- Loan Duration: Typically between 5 to 20 years

- Interest Rates: Fixed or variable; currently ranging from 6.99% to 11.99%, depending on credit profile and loan type

- Loan Amounts: $10,000 to $500,000+

The longer the loan term, the smaller the monthly payment—but the higher the total interest paid over time.

⚖️ Pros and Cons of RV Loans

✅ Advantages

- Affordability: Breaks down large purchase into manageable payments

- Extended Terms: Up to 20 years, suitable for expensive RVs

- Lifestyle Access: Enables travel, vacationing, or even full-time living

- Second Home Deduction: Possible tax benefits if RV qualifies

❌ Disadvantages

- High Total Cost: Long-term loans can lead to significant interest accumulation

- Depreciation: RVs lose value quickly, potentially exceeding loan balance

- Maintenance & Storage Costs: Hidden expenses add to overall financial burden

- Repossession Risk: Defaulting on secured loans could result in loss of the RV

🧮 Loan vs. Lease vs. Rent

Before committing to an RV loan, compare alternatives:

| Option | Key Benefit | Suitable For |

|---|---|---|

| Loan | Full ownership | Long-term use, travel |

| Lease | Lower upfront cost | Occasional travelers |

| Rent | No commitment | Short vacations |

If you’re unsure about RV living, renting might help test the waters without financial commitment.

📖 Real-Life Example

Consider Rajiv, a 35-year-old software engineer from Bhubaneswar who wants to live and work remotely across India in a high-end motorhome. He finds a model costing ₹45 lakh and applies for a loan through a national bank. With a credit score of 750 and 20% down payment, he secures a loan of ₹36 lakh over 15 years at an 8.5% interest rate. His monthly EMI is roughly ₹35,900, which aligns with his budget, allowing him to pursue a nomadic lifestyle while maintaining financial stability.

🔧 Tips for Smart RV Financing

Want to make the most of your RV loan? Here’s how:

- Check Your Credit Score First

- Save for a Larger Down Payment to lower your principal and interest

- Shop Around for lenders, don’t settle for dealership options alone

- Consider Used RVs to reduce purchase cost and potential depreciation

- Read Fine Print on insurance, maintenance, and warranties

- Plan Ahead for seasonal storage, repairs, and upgrades

🧭 Future of RV Loans

As remote work culture continues to grow, RV demand—and corresponding loan products—are expected to diversify. Innovations in solar-powered units, smart home integrations, and sustainable design may increase initial costs but broaden the market for specialized financing.

Additionally, fintech platforms are starting to offer AI-based loan matching, improving access for younger buyers and digital nomads.

🎯 Conclusion

RV loans are the bridge between dream and reality—unlocking the freedom to explore without compromising financial health. From choosing between secured or unsecured loans to understanding repayment obligations and lifestyle fit, navigating RV financing requires informed decision-making. With proper planning, borrowers can enjoy the thrills of the open road and the comfort of home, wherever they go.

Would you like a graphical breakdown of loan types next, Dex? Or a comparison table with auto loans and home loans for context?