What is a Debt Consolidation Loan?

A debt consolidation loan is a type of financing that allows individuals to combine multiple debts into a single loan with a single monthly payment. This can simplify the management of debts and potentially reduce the interest rate, helping borrowers pay off their debts more efficiently.

How Does Debt Consolidation Work?

Debt consolidation involves taking out a new loan to pay off existing debts. These debts might include credit card balances, personal loans, medical bills, and other high-interest debts. The borrower then makes payments on the new loan, ideally with more favorable terms, such as a lower interest rate or a longer repayment period.

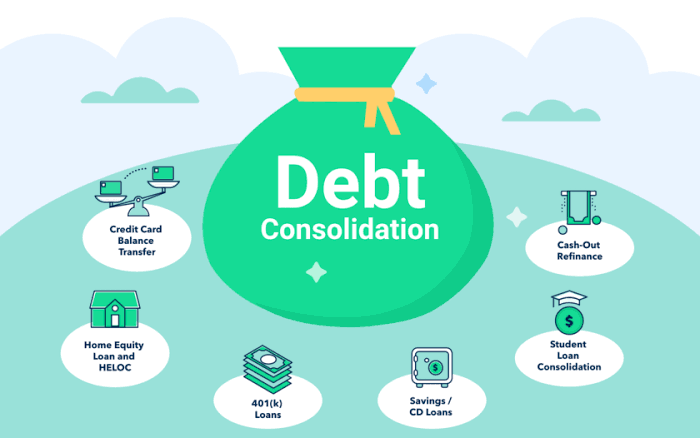

Types of Debt Consolidation Loans

There are several types of debt consolidation loans, each with its own advantages and disadvantages:

- Unsecured Personal Loans: These loans do not require collateral and are based on the borrower’s creditworthiness. Interest rates can vary widely depending on the borrower’s credit score.

- Secured Loans: These loans are backed by collateral, such as a home or car. They often come with lower interest rates but carry the risk of losing the collateral if the borrower defaults on the loan.

- Home Equity Loans: These loans allow homeowners to borrow against the equity in their homes. They often offer lower interest rates, but the home is used as collateral.

- Balance Transfer Credit Cards: Some credit cards offer low or zero-interest promotional rates for balance transfers. Borrowers can transfer their existing high-interest debts to these cards, but it’s essential to pay off the balance before the promotional period ends to avoid high interest rates.

Benefits of Debt Consolidation Loans

Debt consolidation loans can offer several benefits, including:

- Simplified Payments: Combining multiple debts into a single loan means only one monthly payment to keep track of, reducing the likelihood of missed payments.

- Lower Interest Rates: Borrowers with good credit may qualify for lower interest rates, reducing the overall cost of the debt.

- Fixed Repayment Schedule: Debt consolidation loans typically come with a fixed repayment schedule, making it easier to plan and budget.

- Improved Credit Score: By paying off high-interest debts and making timely payments on the new loan, borrowers can improve their credit scores over time.

Potential Drawbacks of Debt Consolidation Loans

While debt consolidation loans offer many benefits, there are also potential drawbacks to consider:

- Origination Fees and Costs: Some loans come with origination fees, which can add to the overall cost of the loan.

- Longer Repayment Periods: Extending the repayment period may lower monthly payments but could result in paying more interest over the life of the loan.

- Risk of Collateral Loss: For secured loans, failing to make payments can result in the loss of the collateral, such as a home or car.

- Impact on Credit Score: Applying for a new loan can result in a hard inquiry on your credit report, which may temporarily lower your credit score.

How to Choose the Right Debt Consolidation Loan

Selecting the right debt consolidation loan involves careful consideration of several factors:

- Interest Rates: Compare interest rates from different lenders to find the most favorable terms.

- Fees and Costs: Be aware of any origination fees, prepayment penalties, and other costs associated with the loan.

- Repayment Terms: Consider the length of the repayment period and whether it aligns with your financial goals.

- Credit Requirements: Ensure you meet the lender’s credit requirements to qualify for the loan.

- Lender Reputation: Research the lender’s reputation and read reviews from other borrowers.

Steps to Obtain a Debt Consolidation Loan

Here’s a step-by-step guide to obtaining a debt consolidation loan:

- Assess Your Debts: Compile a list of all your existing debts, including balances, interest rates, and monthly payments.

- Check Your Credit Score: Obtain a copy of your credit report to understand your credit standing.

- Research Lenders: Compare different lenders’ offers, including interest rates, fees, and repayment terms.

- Apply for the Loan: Submit your application to the chosen lender, providing necessary documentation such as proof of income and identification.

- Review Loan Terms: Carefully review the loan terms, including interest rates, repayment schedule, and any fees.

- Pay Off Existing Debts: Use the loan funds to pay off your existing debts, and begin making payments on the new loan.

Alternatives to Debt Consolidation Loans

If a debt consolidation loan isn’t the right fit for you, consider these alternatives:

- Debt Management Plans: Nonprofit credit counseling agencies can help you create a debt management plan, negotiating lower interest rates with creditors.

- Debt Settlement: Debt settlement involves negotiating with creditors to reduce the total amount owed. This option can have a negative impact on your credit score.

- Bankruptcy: As a last resort, filing for bankruptcy can provide relief from overwhelming debt, but it comes with significant long-term consequences for your credit.

Final Thoughts

Debt consolidation loans can be an effective tool for managing and paying off multiple debts. However, it’s essential to carefully evaluate your financial situation and consider all options before making a decision. By understanding the benefits and potential drawbacks, you can make an informed choice that aligns with your financial goals.

If you have any specific questions or need further information on any aspect of debt consolidation, feel free to ask!