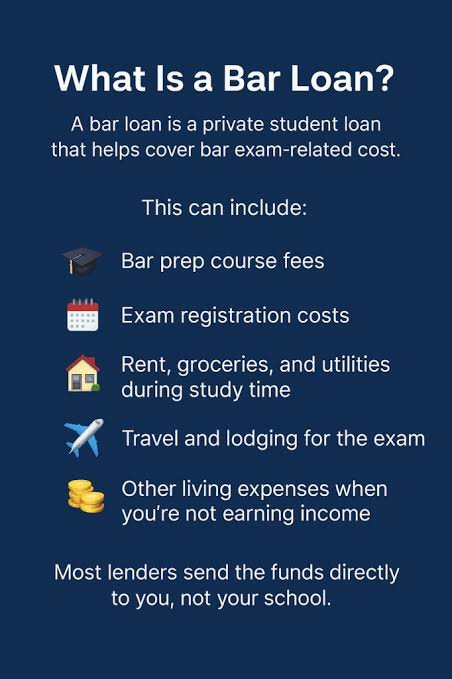

A bar exam loan is a specialized private loan that covers bar prep courses, exam fees, and short-term living costs while studying, typically offering up to about $15,000 with fixed or variable APRs and repayment terms up to 15 years. These loans are distinct from federal student loans, are credit-based, may include autopay discounts, and often provide a short grace or deferment period post-exam before full repayment begins.

What it covers

- Bar review course tuition, exam registration, character and fitness fees, travel, and living expenses not included in a school’s cost of attendance are commonly eligible uses, with funds often disbursed directly to the student for flexibility.

- Because studying limits income, lenders design these loans to bridge the months leading up to and immediately after the exam, but borrowers remain responsible for repayment even if the first attempt isn’t successful.

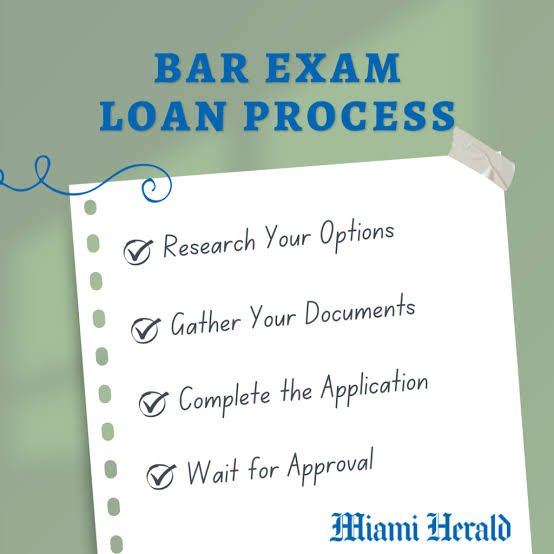

Eligibility basics

- Typical eligibility includes being a JD/LLM student in the final year or a recent graduate within 12 months, planning to sit for the bar within 6–12 months after graduation, and meeting credit criteria or applying with a qualified cosigner; international graduates usually need a U.S. citizen/permanent resident cosigner.

- Lenders impose school participation lists and aggregate caps across education debt; for example, some lenders limit total student debt considered for approval, which can affect bar loan eligibility.

Rates, terms, and discounts

- Published ranges in 2025 show fixed APRs roughly in the mid-3% to mid-teens and variable APRs that can start in the mid-4% range, with term lengths up to 15 years; actual offers depend on credit, cosigner strength, and selected repayment plan.

- Autopay discounts are common, such as 0.25% with certain lenders and up to 0.50% in some cases, and some lenders offer grace periods around 6–9 months before full payments are due.

Pros and cons

- Advantages: targeted funding for bar-period expenses, flexible use of funds beyond school COA, and optional deferment or interest-only periods to reduce initial burden while awaiting licensure and employment.

- Trade-offs: higher pricing than federal loans, potential for double-digit APRs for many applicants, and full repayment obligation regardless of bar passage or job outcomes, which makes rate shopping and conservative borrowing prudent.

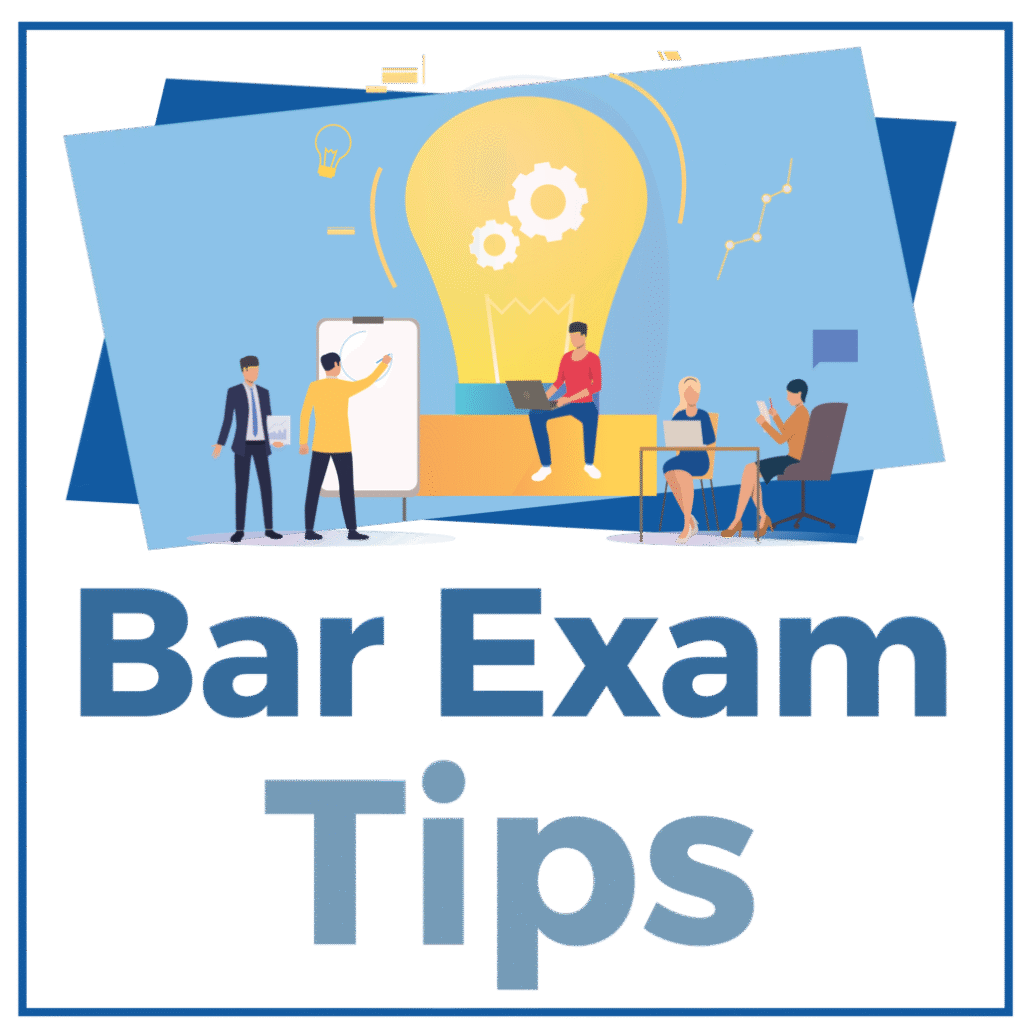

Practical shopping tips

- Compare at least two to three lenders on APR ranges, autopay discounts, maximum loan amount, repayment flexibility, and hardship options such as forbearance; independent comparisons and school financial aid pages aggregate current terms for quick benchmarking.

- Prequalification via soft credit checks where available can help estimate rates without impacting credit, and marketplaces for private student loans can provide multiple offers efficiently to inform the bar loan decision.

Alternatives to consider

- Increasing savings during 3L year, employer stipends, or firm advances can reduce borrowing needs; some private student loans or personal loans may offer different rate structures or protections worth comparing for cost and flexibility.

- If already holding private debt, refinancing after employment may lower rates, but it forfeits any original lender benefits; always weigh hardship protections and grace periods in addition to headline APRs.

Lender snapshots

- Sallie Mae: Fixed APR roughly 7.01%–15.26% and variable 7.13%–16.74% advertised for bar study loans, up to $15,000, 9-month grace, 0.25% autopay discount, and up to 15-year terms; standard eligibility applies to recent JD/LLM graduates.

- PNC Bank: Offers bar study loans with autopay discount up to 0.50%, terms up to 15 years, and typical maximum around $15,000, with total student debt caps considered in underwriting; timing to sit for the bar is a factor.

Compare at a glance

How to decide

- Borrow only what is needed to cover bar-specific costs and a modest living buffer, then prioritize the lowest total cost: the combination of APR, fees, discounts, and term-driven interest expense over the life of the loan.

- Stress-test repayment assuming delayed employment or a retake; lenders’ hardship and forbearance policies matter as much as rate when cash flow is uncertain immediately after graduation.

Key takeaway

A bar exam loan can be a helpful, short-term bridge to cover bar prep and living costs, but it’s still debt: compare multiple offers, verify grace and hardship policies, and aim for the lowest all-in cost while preserving flexibility during the transition into legal practice.