The SBA 504 Loan Program is a specialized financing solution designed by the U.S. Small Business Administration (SBA) to support small businesses in acquiring major fixed assets that drive growth and job creation. This program is particularly attractive for businesses seeking to purchase or improve real estate, construct new facilities, or acquire long-term machinery and equipment.

What Is an SBA 504 Loan?

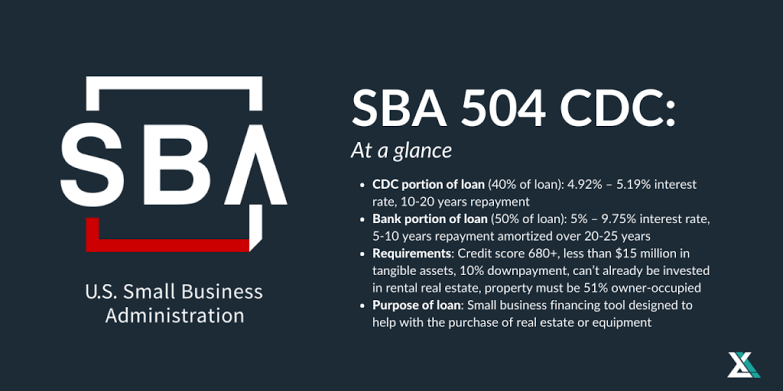

The SBA 504 loan provides long-term, fixed-rate financing for the purchase or improvement of fixed assets. The program is administered in partnership with Certified Development Companies (CDCs)—nonprofit organizations certified and regulated by the SBA—and traditional lenders such as banks or credit unions. The maximum SBA-backed portion is typically $5 million, but can go up to $5.5 million for manufacturers or projects meeting specific public policy goals.

Key Features and Benefits

- Low Down Payment: Borrowers usually contribute only 10% of the total project cost, preserving working capital for other business needs.

- Fixed Interest Rates: The SBA-backed portion of the loan is offered at a fixed, below-market rate, providing predictability for long-term budgeting.

- Long Repayment Terms: Loans are available with 10, 20, or 25-year terms for real estate and 10 years for equipment, keeping monthly payments affordable.

- High Loan-to-Value (LTV): Up to 90% financing is possible, with the bank covering 50%, the CDC/SBA 40%, and the borrower 10%.

- Retain Working Capital: Because of the low down payment, businesses can maintain liquidity for operations and growth.

Eligible Uses of SBA 504 Loans

SBA 504 loans are specifically intended for major fixed assets that promote business expansion and job creation. Eligible uses include:

- Purchase of existing buildings or land

- Construction of new facilities

- Renovation or modernization of existing facilities

- Acquisition of long-term machinery and equipment (with a useful life of at least 10 years)

- Improvement of land, streets, utilities, parking lots, and landscaping

- Refinancing qualified debt related to fixed asset acquisition (subject to SBA criteria)

Ineligible uses include working capital, inventory, debt consolidation (unless it meets specific SBA definitions), and investment in rental real estate or speculation.

Eligibility Requirements

To qualify, a business must:

- Operate as a for-profit entity in the United States or its territories

- Have a tangible net worth less than $15 million (some sources cite $20 million)

- Have an average net income after taxes of less than $5 million for the prior two years (some sources cite $6.5 million)

- Meet SBA size standards for small businesses

- Demonstrate qualified management, a feasible business plan, good character, and the ability to repay the loan

- Occupy at least 51% of the property for existing buildings (or 60% for new construction) if real estate is being financed

- Not be engaged in nonprofit, passive, or speculative activities

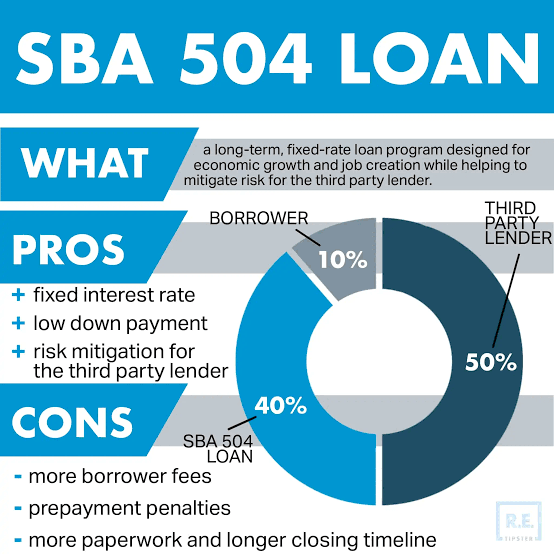

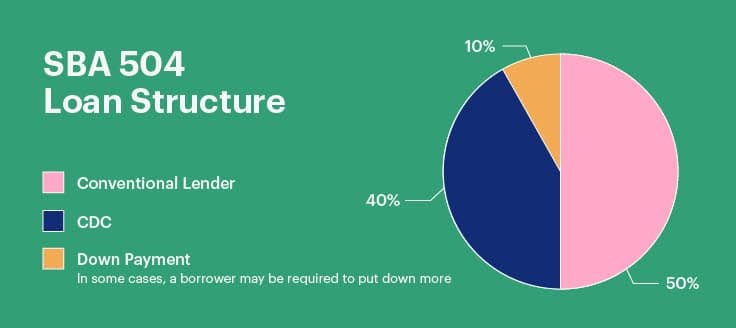

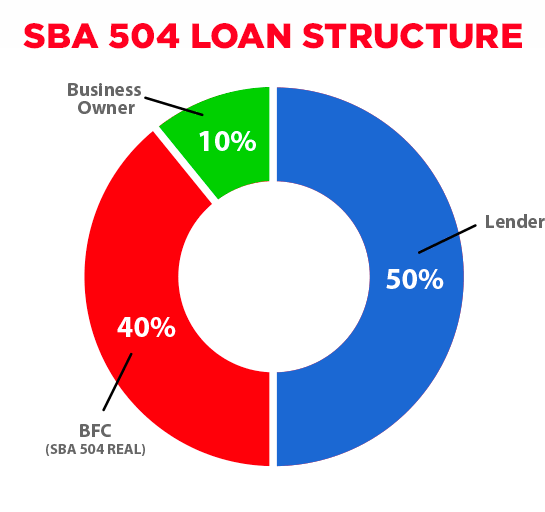

Structure of an SBA 504 Loan

The typical financing structure for an SBA 504 loan is as follows:

| Source | Percentage of Project Cost |

|---|---|

| Bank/Lender | 50% |

| CDC/SBA | 40% |

| Borrower | 10% |

- The bank holds a senior lien on the financed asset.

- The CDC/SBA portion is funded by a 100% SBA-guaranteed debenture and holds a junior lien.

- The borrower’s equity is typically a cash contribution but may include existing equity in the project for expansions.

The Application Process

The SBA 504 loan process generally follows these steps:

- Project Planning: Identify the fixed asset(s) to be financed and prepare a business plan.

- Application Submission: Apply simultaneously with a participating lender and a CDC.

- Approval: The lender, CDC, and SBA review and approve the application.

- Interim Financing: The lender typically provides interim financing for the full project cost.

- CDC/SBA Funding: Upon project completion and documentation, the CDC/SBA funds its portion, repaying the lender’s interim loan.

- Repayment: The borrower repays the loan according to the agreed terms.

Required documentation includes financial statements, tax returns, business plans, and details about the project and collateral.

Collateral and Guarantees

- Collateral: The assets being financed usually serve as collateral.

- Personal Guarantees: Owners with 20% or more interest in the business must provide personal guarantees.

Fees and Prepayment Penalties

- Fees: There are various fees, including processing, closing, and servicing fees, which are typically financed as part of the loan.

- Prepayment Penalty: A declining prepayment penalty applies for half the term of the loan (e.g., 10 years on a 20-year loan), which compensates investors in SBA 504 debentures.

SBA 504 vs. SBA 7(a) Loans

| Feature | SBA 504 Loan | SBA 7(a) Loan |

|---|---|---|

| Primary Use | Fixed assets (real estate, equipment) | Working capital, inventory, etc. |

| Maximum SBA Portion | $5 million ($5.5 million for manufacturers) | $5 million |

| Down Payment | Typically 10% | Varies |

| Interest Rate | Fixed, below-market | Variable or fixed |

| Repayment Term | 10, 20, or 25 years (fixed assets) | Up to 25 years |

| Structure | Bank 50%, CDC/SBA 40%, Borrower 10% | Bank/SBA |

Community and Economic Impact

The SBA 504 loan program is designed as an economic development tool. By enabling small businesses to invest in their own facilities and equipment, the program fosters job creation, business expansion, and community revitalization. SBA expects loan recipients to create or retain jobs or meet other public policy goals as a condition of funding.

Conclusion

The SBA 504 loan is a powerful resource for small businesses looking to make substantial investments in their physical infrastructure. Its combination of low down payment, fixed rates, and long repayment terms makes it an attractive alternative to conventional financing for eligible businesses focused on growth and job creation. For more details or to begin the application process, businesses should consult with a local Certified Development Company (CDC) or their financial institution.