What is an Emergency Loan?

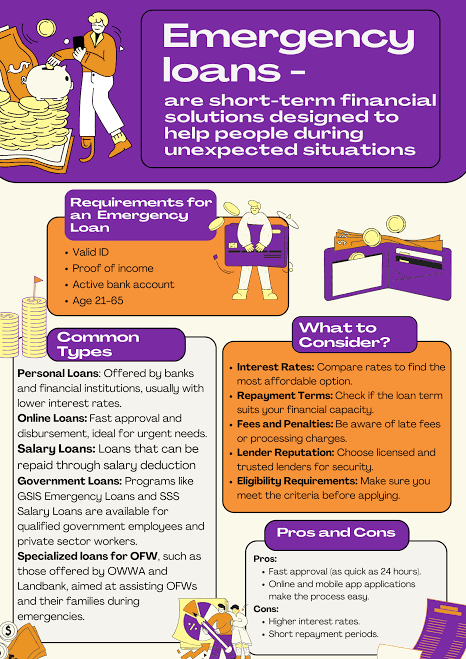

An emergency loan is a fast, unsecured personal loan designed to provide immediate cash for urgent needs like medical bills, car repairs, or sudden travel. No collateral is required, and approval is typically quick-sometimes within minutes or hours.

Features of a ₹1000 Emergency Loan

- Loan Amount: As low as ₹1000, available from many online lenders and microfinance institutions.

- Approval Speed: Instant or same-day approval and disbursal are common, especially with online apps.

- Eligibility: Usually, you must be at least 18 years old, have a regular income (some lenders require a minimum monthly income, e.g., ₹15,000), and provide basic documents like PAN, Aadhaar, and proof of income.

- Tenure: Repayment terms can be short, such as 11 weeks for microfinance loans, or longer for personal loans.

- Usage: Can be used for any urgent expense-medical, home or vehicle repairs, or emergency travel.

Application Process

- Complete an online application with basic personal and financial details.

- Submit required documents (ID, income proof, bank details).

- Receive instant approval and direct transfer to your bank account.

Pros and Cons

| Pros | Cons |

|---|---|

| Fast approval and disbursal | Higher interest rates |

| No collateral required | Short repayment period (in some cases) |

| Flexible usage | Potential impact on credit score if not repaid on time |

Important Considerations

- Always check the interest rate and total repayment amount before accepting the loan.

- Make sure you can repay on time to avoid penalties and negative credit impact.

- Emergency loans are best for genuine, urgent needs-not for regular expenses.

Where to Apply

- Online loan apps like Zype, mPokket, NIRA, CASHe, and others offer quick ₹1000 loans with easy eligibility and minimal paperwork.

- Microfinance institutions like CreditAccess Grameen provide short-term emergency loans for low-income clients.

Conclusion

A ₹1000 emergency loan is a practical solution for urgent, small-scale financial needs. Ensure you understand the terms, can manage the repayment, and use it only when necessary to avoid long-term debt issues.