Installment Loan: An Overview

An installment loan is a type of credit where a borrower receives a lump sum of money upfront and repays it over a set period through regular, fixed payments called installments. These payments typically include both principal and interest, making budgeting easier for borrowers.

Key Features of Installment Loans

- Fixed Repayment Schedule: Borrowers repay the loan in equal monthly installments (EMIs) over a predetermined tenure, which can range from a few months to several years.

- Interest Rate: The rate can be fixed or floating. Fixed rates keep the EMI constant throughout the tenure, while floating rates may cause EMIs to change if market rates fluctuate.

- Principal and Interest: Each installment covers a portion of the principal and the interest. Initially, the interest component is higher, but as the loan progresses, the principal portion increases.

- Amortization Schedule: This is a detailed table showing how much of each payment goes towards principal and interest, and how the outstanding balance reduces over time.

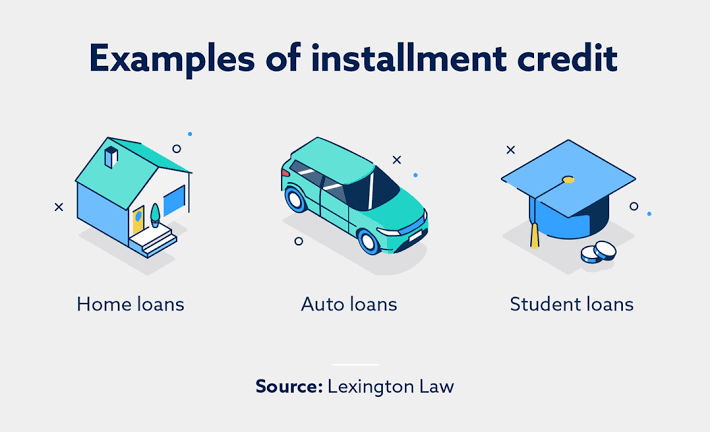

Types of Installment Loans

- Personal Loans: Unsecured loans for various personal needs.

- Home Loans: Secured loans for purchasing property, typically with longer tenures.

- Auto Loans: Loans for buying vehicles, usually secured against the vehicle.

- Education Loans: Loans for funding higher education, often with flexible repayment options.

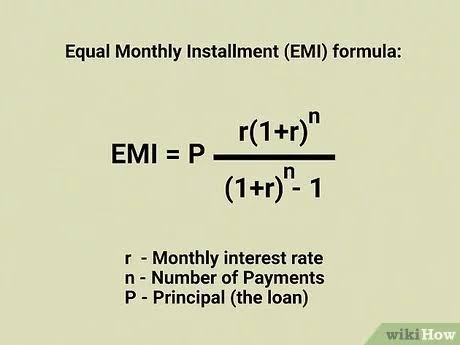

How EMIs Are Calculated

The EMI (Equated Monthly Installment) for an installment loan is calculated using the formula:EMI=P×r×(1+r)n(1+r)n−1EMI=(1+r)n−1P×r×(1+r)n

Where:

- PP = Principal (loan amount)

- rr = Monthly interest rate (annual rate divided by 12)

- nn = Number of monthly installments

Example:

If you borrow ₹1,00,000 at 14% annual interest for 2 years (24 months), the EMI would be approximately ₹4,801.

Factors Affecting Installment Loans

- Loan Amount: Higher amounts lead to higher EMIs.

- Interest Rate: Higher rates increase the EMI and total interest paid.

- Tenure: Longer tenure reduces EMI but increases total interest outgo.

- Credit Score: A higher credit score can help secure lower interest rates.

- Prepayment: Making extra payments can reduce the principal and overall interest, sometimes with a penalty fee.

Repayment and Consequences of Default

- Repayment Methods: EMIs can be paid via bank transfer, post-dated cheques, standing instructions, or other methods, depending on the lender.

- Defaulting: Missing an EMI can result in penalty fees and negatively impact your credit score.

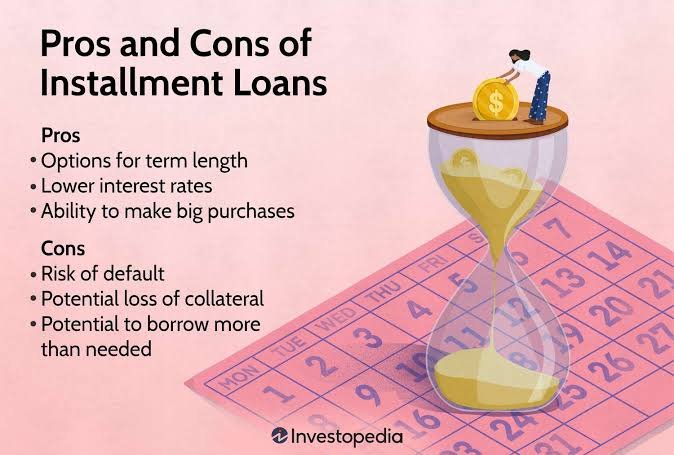

Advantages of Installment Loans

- Predictability: Fixed EMIs make budgeting easier.

- Flexibility: Available for various purposes and tenures.

- Credit Building: Timely repayments improve credit history.

Disadvantages of Installment Loans

- Interest Costs: Longer tenures mean more interest paid overall.

- Penalty Fees: Late or missed payments attract penalties and impact credit score.

- Less Flexibility: Fixed payment schedules may not suit everyone’s cash flow.

Using EMI Calculators

Online EMI calculators help borrowers estimate their monthly payments before taking a loan. By entering the loan amount, interest rate, and tenure, you can quickly see your EMI and plan accordingly.

Typical Use Cases

- Personal Expenses: Medical emergencies, weddings, travel, or home renovation.

- Purchasing Assets: Homes, vehicles, or electronics.

- Education: Funding higher studies or skill development.

Conclusion

Installment loans are a popular and practical way to finance large expenses, offering predictability and structure through fixed EMIs. Borrowers should carefully assess their repayment capacity, compare offers, and use EMI calculators to make informed decisions. Timely repayments are crucial to avoid penalties and maintain a healthy credit score.