The Federal Housing Administration (FHA) Loan program is a cornerstone of American homeownership, designed to make housing accessible to a broader range of individuals, particularly those who might struggle to qualify for conventional mortgages. Administered by the FHA, a part of the U.S. Department of Housing and Urban Development (HUD), this program insures mortgages issued by private lenders, reducing the risk for banks and other financial institutions.

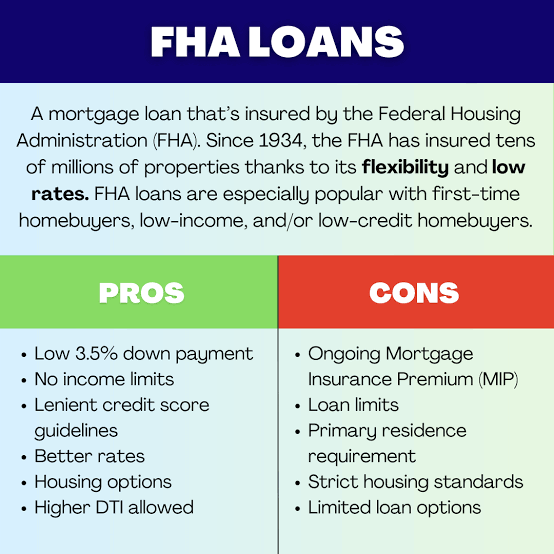

Since its inception in 1934, the FHA has insured over 50 million mortgages, playing a pivotal role in helping low- to moderate-income families, first-time homebuyers, and those with less-than-perfect credit achieve the dream of owning a home. This comprehensive overview explores the structure, requirements, benefits, limitations, and various types of FHA loans, providing a detailed understanding of how they function in the housing market.

What Is an FHA Loan?

An FHA loan is a mortgage insured by the federal government and issued by FHA-approved private lenders, such as banks or mortgage companies. Unlike conventional loans, which often require higher credit scores and larger down payments, FHA loans are tailored for borrowers who may not meet the stringent criteria of traditional financing. The government backing reduces the lender’s risk, encouraging them to offer loans to individuals with lower credit scores or limited savings for a down payment . This makes FHA loans particularly appealing to first-time homebuyers and younger buyers who might otherwise be excluded from the housing market .

The primary mission of the FHA is to facilitate access to reasonably priced mortgage financing, focusing on underserved populations. By insuring loans for single-family homes, multifamily properties, manufactured homes, and even hospital loans, the FHA broadens the scope of homeownership opportunities across diverse demographics.

How FHA Loans Work

FHA loans operate similarly to other mortgages but with the added security of federal insurance. The FHA does not directly lend money; instead, it guarantees loans issued by approved private lenders. If a borrower defaults, the FHA compensates the lender for a portion of the loss, mitigating the financial risk and enabling lenders to approve borrowers who might otherwise be declined. This insurance mechanism is funded through mortgage insurance premiums (MIP) that borrowers are required to pay, both as an upfront fee and as an annual premium included in monthly payments.

Borrowers can choose between fixed or adjustable interest rates and select loan terms typically ranging from 15 to 30 years, mirroring options available with conventional loans. Current FHA loan rates are often competitive, sometimes slightly lower than conventional loan rates. For instance, as of recent data, the national average rate for a 30-year FHA loan stands at 6.62%, compared to 6.83% for a conventional loan. Additionally, FHA loans allow for closing costs—such as appraisal and origination fees—to be covered by home sellers, builders, or lenders up to 6% of the total cost, easing the financial burden on buyers.

FHA Loan Requirements

Qualifying for an FHA loan involves meeting specific criteria, which are generally more lenient than those for conventional mortgages but still include certain stringent conditions. Below are the key requirements:

- Credit Score: Borrowers with a credit score of 580 or higher can qualify for an FHA loan with a down payment as low as 3.5%. Those with scores between 500 and 579 may still qualify but must provide a 10% down payment. In contrast, conventional loans often require a minimum score of 620 .

- Down Payment: The minimum down payment is 3.5% for credit scores of 580 and above, or 10% for scores between 500 and 579. This can come from personal savings, gifts from family, or down payment assistance programs, which are uniquely available for FHA loans .

- Debt-to-Income (DTI) Ratio: The front-end ratio, which includes mortgage payments, property taxes, and insurance, should not exceed 31% of gross income. The back-end ratio, encompassing all monthly debts, should be below 43%, though some lenders may allow higher ratios with compensating factors like a larger down payment .

- Occupancy Rules: FHA loans are strictly for primary residences, applicable to properties with one to four units. They cannot be used for second homes or investment properties .

- Mortgage Insurance Premiums (MIP): Borrowers must pay an upfront MIP of 1.75% of the loan amount, often rolled into the mortgage, and an annual premium ranging from 0.15% to 0.75%, paid monthly, depending on loan size, term, and loan-to-value (LTV) ratio .

- Property Standards: Properties must meet HUD’s minimum standards, verified by a HUD-approved appraiser. This includes structural integrity, adequate drainage, and functional heating, plumbing, and electrical systems .

- Loan Limits: For 2025, FHA loan limits for a single-family home range from $524,225 in low-cost areas to $1,209,750 in high-cost areas, with higher limits in special exception regions like Alaska and Hawaii, reaching up to $1,814,625 .

Types of FHA Loans

The FHA offers a variety of loan programs tailored to different needs beyond the standard home mortgage. These include:

- Basic Home Mortgage Loan (203b): The most common FHA loan, used for purchasing or refinancing a primary residence .

- Rehabilitation Mortgage (203k): Designed for buying and renovating fixer-upper homes, available in Standard and Limited versions with varying renovation scopes and limits .

- Disaster Victim Mortgage (203h): Offers no-down-payment loans to individuals rebuilding or purchasing a new home after a presidentially declared disaster .

- Home Equity Conversion Mortgage (HECM): A reverse mortgage for seniors over 62, allowing them to convert home equity into tax-free income, though it comes with potential drawbacks .

- Energy-Efficient Mortgage (EEM): Supports the purchase or upgrade of energy-efficient homes with features like solar panels or improved insulation .

- Graduated Payment Mortgage (245a): Features payments that start low and increase over time, suitable for borrowers expecting income growth .

Advantages and Disadvantages

FHA loans provide significant benefits, especially for those unable to secure conventional financing. They allow lower credit scores, smaller down payments, and higher DTI ratios, making homeownership accessible to a wider audience. The federal backing ensures lenders are more willing to approve riskier borrowers .

However, there are drawbacks. FHA loans often carry higher interest rates compared to conventional loans for borrowers with strong credit. The mandatory MIP, paid both upfront and monthly, adds to the cost, often lasting for 11 years or the life of the loan unless refinanced into a non-FHA mortgage with at least 20% equity. Additionally, FHA loans are restricted to primary residences and have borrowing limits that may not suffice in high-cost areas .

Applying for an FHA Loan

To apply for an FHA loan, borrowers should contact an FHA-approved lender. The process involves submitting financial documents, including pay stubs, credit history, and employment records. Pre-approval is recommended, as it provides an estimate of borrowing capacity and strengthens a buyer’s position in the housing market. Lenders assess eligibility based on credit, income, and debt levels, ensuring compliance with FHA guidelines .

Conclusion

FHA loans remain a vital tool for expanding homeownership, particularly for first-time buyers and those with financial constraints. By offering flexible eligibility criteria and government-backed security, they bridge the gap for millions who might otherwise be excluded from the housing market. However, the associated costs, such as mortgage insurance premiums and property restrictions, require careful consideration. Understanding the nuances of FHA loans—ranging from requirements and limits to specialized programs—empowers borrowers to make informed decisions about their path to homeownership.