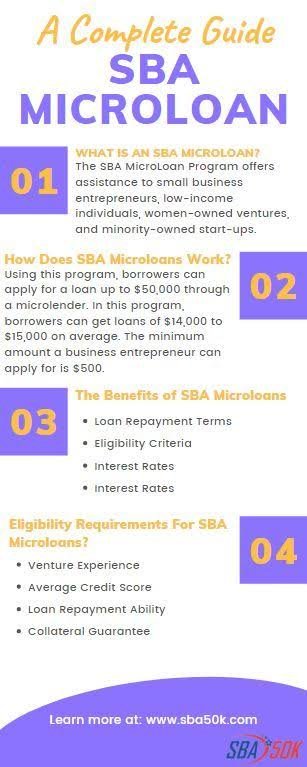

The SBA Microloan Program is a cornerstone initiative by the U.S. Small Business Administration (SBA) aimed at providing small-scale financing to entrepreneurs, startups, and certain not-for-profit childcare centers. With a focus on underserved communities, this program is designed to bridge the gap for business owners who may not qualify for traditional bank loans, such as women, minorities, veterans, and low-income entrepreneurs.

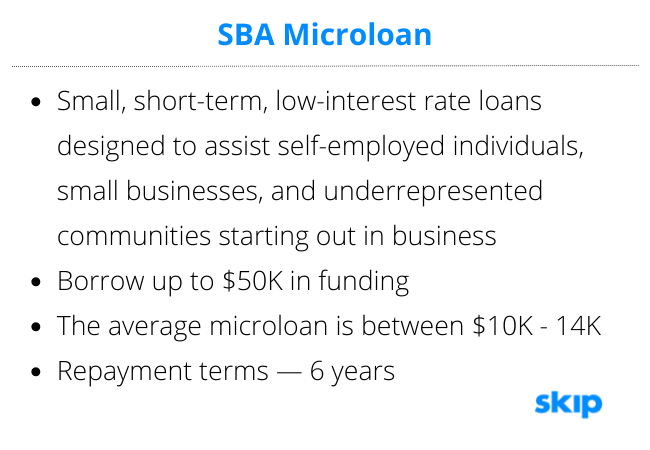

What Is an SBA Microloan?

An SBA microloan is a small business loan of up to $50,000 designed to help businesses start, grow, or recover. The average microloan amount is about $13,000, making it ideal for businesses with modest capital needs. Unlike larger SBA loans, the microloan program is administered through SBA-approved intermediary lenders—typically nonprofit, community-based organizations with experience in lending and providing technical assistance.

How the Program Works

- Funding Flow: The SBA supplies funds to intermediary lenders, who then make loans to eligible small businesses and certain not-for-profit childcare centers.

- Intermediary Role: These lenders are responsible for evaluating, approving, and servicing the loans. They often provide borrowers with technical, management, and marketing assistance, supporting the long-term success of the business.

- Local Decisions: All loan decisions are made at the local level by the intermediary, allowing for more flexible, community-focused lending standards.

Key Features of SBA Microloans

| Feature | Details |

|---|---|

| Maximum Loan Amount | $50,000 |

| Average Loan Amount | $13,000 |

| Repayment Term | Up to 6 years |

| Interest Rate | Typically 8%–13% (varies by lender) |

| Collateral | Often required, but flexible |

| Personal Guarantee | Usually required |

| Fees | 2–4% of loan amount (application/processing) |

- Shorter Terms: The maximum repayment period is six years, and loan terms depend on the size, use of funds, and lender requirements.

- Interest Rates: Rates are generally higher than traditional SBA loans but remain competitive, typically ranging from 8% to 13%.

- Collateral & Guarantees: While many lenders require some form of collateral and a personal guarantee, the requirements are generally less stringent than for larger loans.

Eligible Uses of Funds

Microloans are intended for a wide range of business purposes that support startup or expansion, including178:

- Working capital

- Inventory and supplies

- Furniture and fixtures

- Machinery and equipment

Restrictions: Microloan funds cannot be used to purchase real estate or pay off existing debts.

Who Is Eligible?

Eligibility for an SBA microloan is determined by the intermediary lender, and requirements can vary. However, typical criteria include:

- The business must be a for-profit small business or a qualified not-for-profit childcare center.

- Applicants must generally provide a personal guarantee and some form of collateral.

- The business should operate in the United States.

- The owner must demonstrate the ability to repay the loan.

The program is particularly designed to assist those who may have difficulty accessing traditional financing, such as women, minorities, veterans, and low-income entrepreneurs.

Application Process

- Find an Intermediary: Applicants must locate an SBA-approved intermediary lender in their area.

- Prepare Documentation: Requirements vary, but typically include a business plan, financial statements, tax returns, and details about the intended use of funds.

- Submit Application: The intermediary lender reviews the application, makes the credit decision, and sets the loan terms.

- Technical Assistance: Many intermediaries offer or require business training, mentoring, or workshops as part of the application or loan process.

Repayment and Fees

- Repayment Terms: Up to 6 years, with the exact term set by the intermediary based on the loan size, use, and borrower’s needs.

- Interest Rates: Set by the intermediary, typically between 8% and 13%.

- Fees: Application, processing, and closing fees may total 2–4% of the loan amount.

- Prepayment: Most microloans do not have prepayment penalties, allowing borrowers to repay early without extra cost.

Advantages of SBA Microloans

- Access for Underserved Entrepreneurs: The program targets groups often overlooked by traditional lenders, including women, minorities, veterans, and low-income individuals.

- Flexible Use: Funds can be used for a broad range of business needs, except real estate purchases or debt repayment.

- Technical Assistance: Borrowers often receive free or low-cost business training and support, increasing their chances of success.

- Lenient Requirements: Credit and collateral standards are generally more flexible than those of banks, making microloans accessible to startups and those with limited credit history.

Limitations and Considerations

- Loan Size: The maximum loan amount of $50,000 may not be sufficient for businesses with larger capital needs.

- Interest Rates: Rates are higher than some other SBA loans, reflecting the higher risk and smaller loan size.

- Approval Time: The process can take one to three months, depending on the intermediary and complexity of the application.

- Collateral and Guarantees: While requirements are flexible, most lenders do require some form of collateral and a personal guarantee.

Impact and Community Focus

Since its inception in 1992, the SBA Microloan Program has played a vital role in supporting small businesses and fostering economic growth in local communities. By partnering with nonprofit, community-based intermediaries, the program ensures that lending decisions are made by organizations that understand the unique needs of their regions and can provide ongoing support to borrowers.

Conclusion

The SBA Microloan Program is a critical resource for small businesses and not-for-profit childcare centers in need of modest, flexible financing. Its focus on underserved groups, combined with technical assistance and community-based decision-making, makes it an effective tool for fostering entrepreneurship, job creation, and local economic development. For entrepreneurs seeking to start or expand a business with relatively small capital needs, the SBA microloan offers a combination of accessibility, support, and flexibility rarely matched by conventional lending options.