📘 Introduction

In the evolving landscape of higher education, the cost of college continues to rise sharply. Families across the globe, and particularly in the United States, often face daunting financial barriers when aiming to provide quality education to their children. Among the numerous federal student aid options available, the Federal Direct PLUS Loan stands out as a key resource designed specifically for graduate students and parents of dependent undergraduate students. This essay explores the fundamentals of PLUS Loans, their benefits and limitations, eligibility requirements, repayment structures, and broader impact on educational accessibility.

💼 What Is a PLUS Loan?

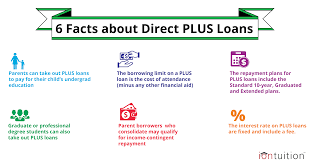

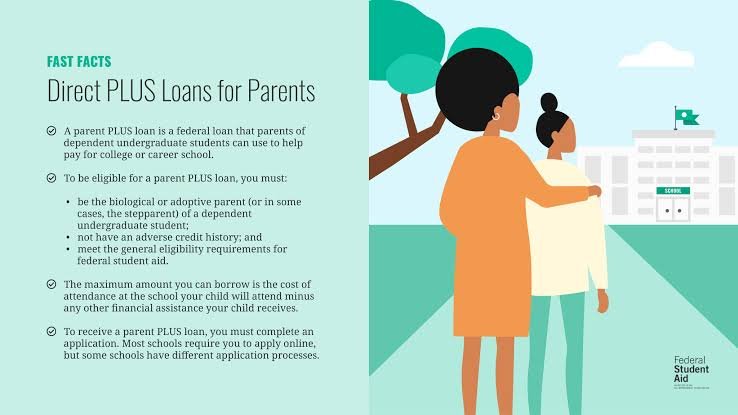

The PLUS Loan (Parent Loan for Undergraduate Students) is a federal loan program under the William D. Ford Federal Direct Loan Program, facilitated by the U.S. Department of Education. Unlike subsidized or unsubsidized student loans, PLUS Loans are extended to:

- Parents of dependent undergraduate students

- Graduate or professional students

These loans are not based on financial need and can be borrowed up to the full cost of attendance minus other financial aid received.

🎓 Types of PLUS Loans

There are two main branches:

| Type | Who Can Apply | Purpose |

|---|---|---|

| Parent PLUS Loan | Parents of dependent undergraduates | Pay for child’s educational cost |

| Grad PLUS Loan | Graduate/professional students | Finance their own education |

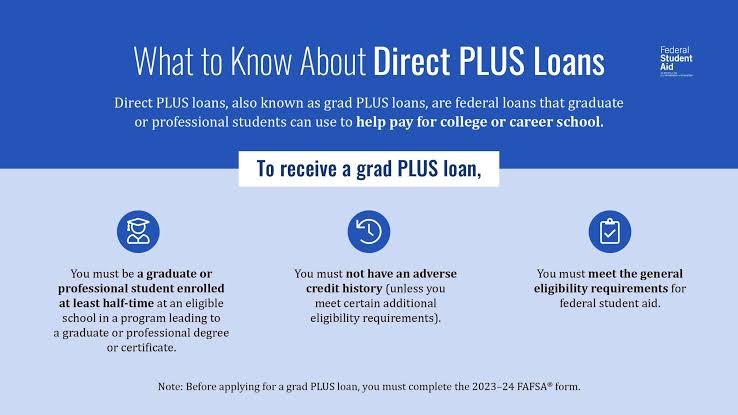

📌 Eligibility Criteria

Unlike other federal loans that prioritize need-based factors, PLUS Loans rely more on credit history and citizenship status. Here are the key requirements:

- The borrower must be a U.S. citizen or eligible non-citizen

- The applicant cannot have an adverse credit history

- For Parent PLUS, the student must be dependent and enrolled at least half-time in an eligible institution

- For Grad PLUS, the student must be enrolled at least half-time in a graduate or professional program

💰 Interest Rates and Fees

Interest rates for PLUS Loans tend to be higher than other federal student loans. As of recent figures (subject to change annually):

- Interest Rate: Fixed, around 8.05% (as of 2023–2024 cycle)

- Origination Fee: Approximately 4.228% deducted before disbursement

These rates reflect the non-subsidized nature of the loan. Interest begins accruing from the moment funds are disbursed.

🔄 Repayment Plans

Repayment for PLUS Loans begins immediately after full disbursement unless deferred. However, options include:

For Parent PLUS:

- Standard Repayment (10 years)

- Extended Repayment (up to 25 years)

- Graduated Repayment

- Limited Income-Contingent Repayment (ICR) via consolidation

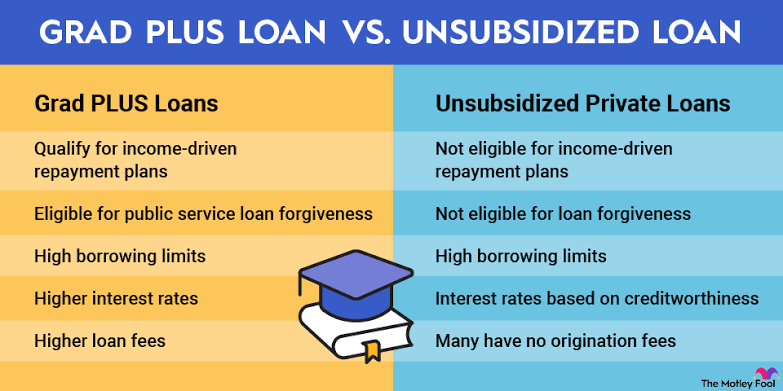

For Grad PLUS:

- Access to Income-Driven Repayment Plans

- Eligibility for Public Service Loan Forgiveness (PSLF)

📉 Pros and Cons

Let’s break it down:

✅ Pros

- Covers full cost of attendance

- Federal protections (deferment, forbearance)

- Fixed interest rate

- Available regardless of income level

❌ Cons

- Higher interest rates than Stafford Loans

- Limited repayment flexibility for parents

- Cannot be discharged easily in bankruptcy

- Creates significant debt burden, especially for low-income families

🌐 Impact on Accessibility

PLUS Loans have played a substantial role in expanding access to education, allowing many families to bridge the financial gap when grants and scholarships fall short. However, they have also raised concerns around equity and affordability:

- Families from marginalized communities may overextend themselves financially

- Some critics argue that the unlimited borrowing cap encourages institutions to raise tuition

- Research indicates higher default risk among low-income borrowers

📊 Real-Life Example

Take the case of a middle-income family whose child is accepted into a prestigious private university with tuition costs of $70,000 per year. After scholarships and federal aid, $30,000 remains uncovered. A Parent PLUS Loan allows the family to finance that gap. But over four years, this could result in over $120,000 in principal debt—excluding interest—which, if taken without proper planning, becomes a long-term financial challenge.

🧩 Alternatives and Tips

While PLUS Loans are valuable, borrowers should consider:

- Exhausting subsidized and unsubsidized loans first

- Exploring private scholarships and work-study

- Weighing 529 plans and college savings

- Understanding repayment obligations before signing

🏁 Conclusion

PLUS Loans offer a powerful yet complex financial tool to access higher education. They symbolize hope for families wanting the best for their children and for graduate students striving to climb academic ladders. However, like any financial commitment, they require informed decisions, planning, and realistic expectations. As higher education continues to evolve, striking the balance between opportunity and affordability becomes increasingly vital—and PLUS Loans sit right at the heart of that challenge.

Want me to summarize it or add a visual breakdown of the loan cycle next?