An unsecured loan is a type of loan that does not require the borrower to provide any collateral, such as property or assets, to secure the loan. Instead, lenders evaluate the borrower’s creditworthiness and ability to repay the loan based on factors like credit history, income, and financial stability. Unsecured loans are commonly used for personal expenses, debt consolidation, home improvements, and other financial needs. In this comprehensive guide, we’ll explore the benefits, risks, types, and application process of unsecured loans, as well as tips for managing them effectively.

What Are Unsecured Loans?

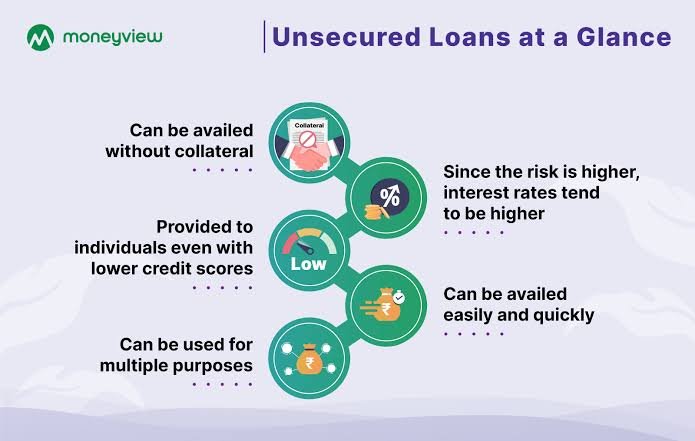

Unsecured loans, also known as personal loans, are loans that do not require any collateral. Unlike secured loans, which are backed by assets like a house or car, unsecured loans are granted based on the borrower’s creditworthiness and financial profile. This means that if the borrower defaults on the loan, the lender cannot seize any property or assets. Instead, the lender may take legal action to recover the debt.

Types of Unsecured Loans

There are several types of unsecured loans, each serving different purposes:

- Personal Loans: Personal loans are versatile and can be used for various purposes, such as consolidating debt, financing home improvements, covering medical expenses, or paying for a wedding. They typically come with fixed interest rates and repayment terms ranging from one to seven years.

- Credit Cards: Credit cards are a form of revolving credit, allowing borrowers to make purchases up to a certain credit limit and repay the balance over time. Interest is charged on the outstanding balance if it is not paid in full each month.

- Student Loans: Some student loans, particularly those issued by private lenders, are unsecured. These loans are used to finance higher education expenses, such as tuition, books, and living costs.

- Personal Lines of Credit: A personal line of credit is a flexible borrowing option that provides access to funds up to a predetermined limit. Borrowers can withdraw money as needed and repay it over time, with interest charged only on the amount borrowed.

- Payday Loans: Payday loans are short-term, high-interest loans typically due on the borrower’s next payday. They are designed to provide quick cash for emergency expenses but come with significant risks due to their high fees and interest rates.

Benefits of Unsecured Loans

Unsecured loans offer several advantages for borrowers:

- No Collateral Required: One of the main benefits of unsecured loans is that they do not require any collateral. This means borrowers do not risk losing their property or assets if they default on the loan.

- Flexible Use: Unsecured loans can be used for a wide range of purposes, providing flexibility for borrowers to address various financial needs.

- Quick Approval: The approval process for unsecured loans is often faster than for secured loans, as there is no need to appraise or verify collateral. Many lenders offer online applications with quick decisions and funding.

- Fixed Interest Rates: Many personal loans come with fixed interest rates, which means the interest rate remains the same throughout the loan term. This provides predictability and helps borrowers budget their monthly payments.

- Build Credit: Successfully managing an unsecured loan and making timely payments can help improve the borrower’s credit score and credit history.

Risks and Considerations

While unsecured loans offer several benefits, there are also risks and considerations to keep in mind:

- Higher Interest Rates: Since unsecured loans do not require collateral, lenders face a higher level of risk. To compensate, they often charge higher interest rates compared to secured loans. Borrowers with lower credit scores may face even higher rates.

- Credit Score Impact: The borrower’s credit score plays a significant role in determining the interest rate and loan approval. Borrowers with poor credit may have difficulty qualifying for unsecured loans or may receive less favorable terms.

- Repayment Obligations: Failing to make timely payments on an unsecured loan can negatively impact the borrower’s credit score and result in additional fees and interest charges. In some cases, lenders may take legal action to recover the debt.

- Debt Accumulation: Taking out an unsecured loan adds to the borrower’s overall debt burden. It’s important to carefully consider the ability to repay the loan and avoid overextending financially.

- Variable Interest Rates: Some unsecured loans, such as credit cards and personal lines of credit, come with variable interest rates that can fluctuate over time. This can lead to higher borrowing costs if interest rates rise.

Applying for an Unsecured Loan

The application process for an unsecured loan typically involves the following steps:

- Assess Your Financial Needs: Determine the amount you need to borrow and how you plan to use the funds. Consider your monthly budget and ability to repay the loan.

- Check Your Credit Score: Before applying, check your credit score and review your credit report for any errors or inaccuracies. A higher credit score increases your chances of approval and better loan terms.

- Compare Lenders: Research and compare lenders to find the best unsecured loan options. Consider factors such as interest rates, repayment terms, fees, and customer reviews.

- Gather Documentation: Prepare the necessary documentation, such as proof of income, identification, and employment history. Lenders may also request information about your debts and financial obligations.

- Submit the Application: Complete the loan application, either online or in person, and submit the required documentation. Be honest and accurate in providing information.

- Review Loan Offers: If approved, review the loan offers and carefully read the terms and conditions. Pay attention to the interest rate, repayment schedule, and any fees or penalties.

- Accept the Loan: Once you have selected the best loan offer, accept the terms and sign the loan agreement. The lender will disburse the funds to your account, and you can use the money as needed.

Managing Unsecured Loans Effectively

Effective management of unsecured loans is essential to maintain financial stability and avoid debt-related issues. Here are some tips for managing unsecured loans:

- Create a Repayment Plan: Develop a clear repayment plan that outlines your monthly payments and budget. Make sure to allocate sufficient funds to cover the loan payments each month.

- Make Timely Payments: Always make your loan payments on time to avoid late fees and negative impacts on your credit score. Set up automatic payments or reminders to help you stay on track.

- Pay More Than the Minimum: If possible, pay more than the minimum monthly payment to reduce the principal balance faster and save on interest costs.

- Avoid Taking on Additional Debt: Be cautious about taking on additional debt while repaying an unsecured loan. Focus on paying down existing debt before considering new loans or credit lines.

- Monitor Your Credit: Regularly monitor your credit score and credit report to track your progress and identify any potential issues. Address any inaccuracies or discrepancies promptly.

- Communicate with Your Lender: If you encounter financial difficulties and struggle to make payments, communicate with your lender. They may offer options such as loan modification, deferment, or hardship programs.

Conclusion

Unsecured loans are a valuable financial tool that can help individuals and families address various financial needs without the requirement of collateral. While they offer flexibility and quick access to funds, it’s essential to carefully consider the terms, interest rates, and repayment obligations. By understanding the benefits and risks, comparing lenders, and managing loans responsibly, borrowers can make informed decisions and use unsecured loans to achieve their financial goals. Whether you’re consolidating debt, financing a major purchase, or covering unexpected expenses, unsecured loans provide a convenient and accessible option for securing the funds you need.