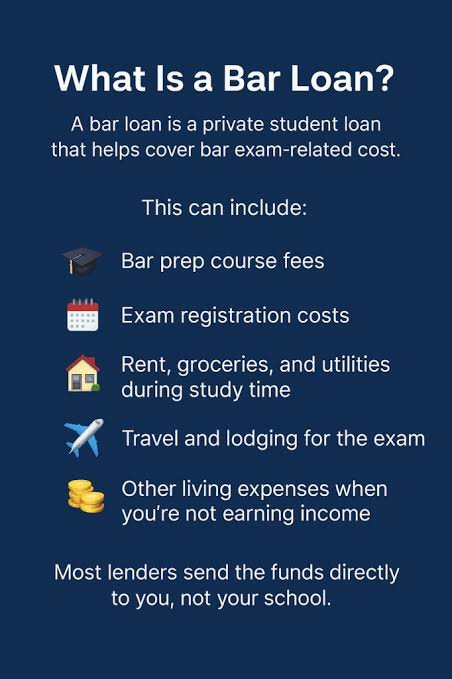

Bar Exam Loan is a specialized private loan.

A bar exam loan is a specialized private loan that covers bar prep courses, exam fees, and short-term living costs while studying, typically offering up to about $15,000 with fixed or variable APRs and repayment terms up to 15 years. These loans are distinct from federal student loans, are credit-based, may include autopay discounts, and often provide